June 2, 2023

Bear Market Rebound Indecisive

The “most telegraphed recession” in history is yet to arrive as the economy, markets, and inflation remain stubbornly strong despite the Fed’s aggressive increase in interest rates and quantitative tightening over the past year. Taming inflation requires proactively cooling the economy, hopefully without crashing it. In spite of the actions taken thus far, spending for travel and entertainment remains particularly strong and May payrolls rose 339,000, which was much stronger than the 190,000 economists expected. Additionally, the most recent inflation readings indicate its persistence. Analysts suggest that this combination may provide cover for the Fed to be a bit more aggressive and hike rates another quarter percent in June.

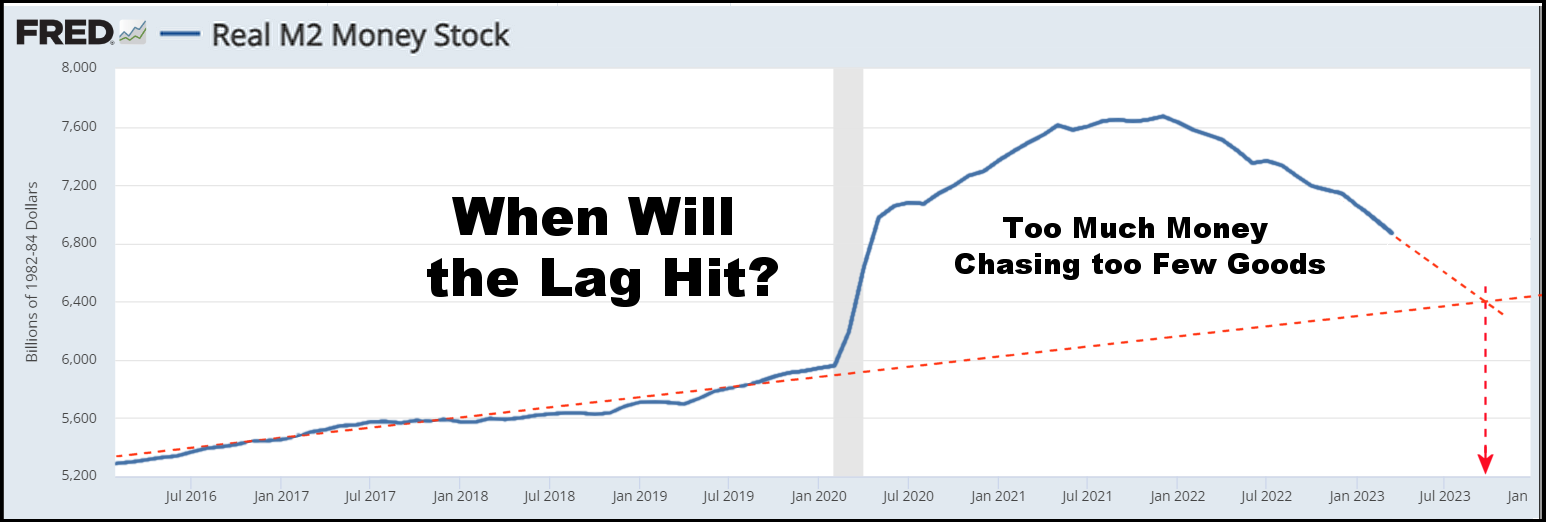

The leading theory (in my view) for why the economy and markets have held up so well in the face of the Fed’s recent tightening policies is tied to the surplus cash ($Trillions) injected into the economy by both the Fed and Congress in their policy responses to the Covid 19 pandemic. Until that surplus is depleted (spent) consumers will not sufficiently feel the pinch to change habits. Thus, the typical lag between fiscal policy change and its effects on the economy would naturally be expected to be longer than usual. Meanwhile, in the short term, markets have been jostled by the debt ceiling/budget deadline relief rally and the imaginative prospects for how AI will change everything.

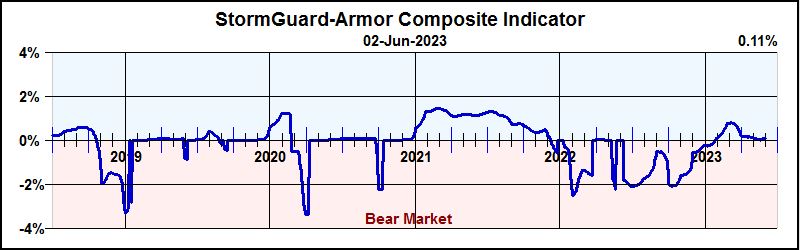

StormGuardTM Remains On the Edge

While two of StormGuard’s three primary components remain positive, it only takes one of them to be negative and declining to trigger StormGuard at month-end. The Value Sentiment Indicator looked like it would trigger StormGuard at the end of May, but the successful negotiation of the debt ceiling and Federal budget appears to have put some bounce in the step of investors … just enough to avert triggering. While the economy’s reaction to the Fed’s policies will almost certainly catch up with us in the months ahead, for now sentiment remains barely bullish.

StormGuard Remains On Edge as Bear Rally Waivers

This is What Divergence Looks Like

A strong bull market generally lifts all ships. However, in recent months, just seven tech stocks have been primarily responsible for the market’s recent rally. The chart (right) illustrates the sharp divergence between large-cap tech and the rest of the market. This market rally began with ChatGPT providing free accounts for anyone to experiment with its AI software. As it became a media feeding frenzy, other AI developers (such as Meta) quickly jumped in to grab their fair share of headlines. Of course, in relatively short order the chip makers (such as Nvidia) saw orders head strongly higher as it is clear that the race is on. While the potential is immense, AI profitability (for other than chips) is likely years away, not quarters. Will this divergence have legs to last through a recession?

QQQ: Nasdaq tech-heavy index

MDY: Broad mid-cap index

SLY: Broad small-cap index

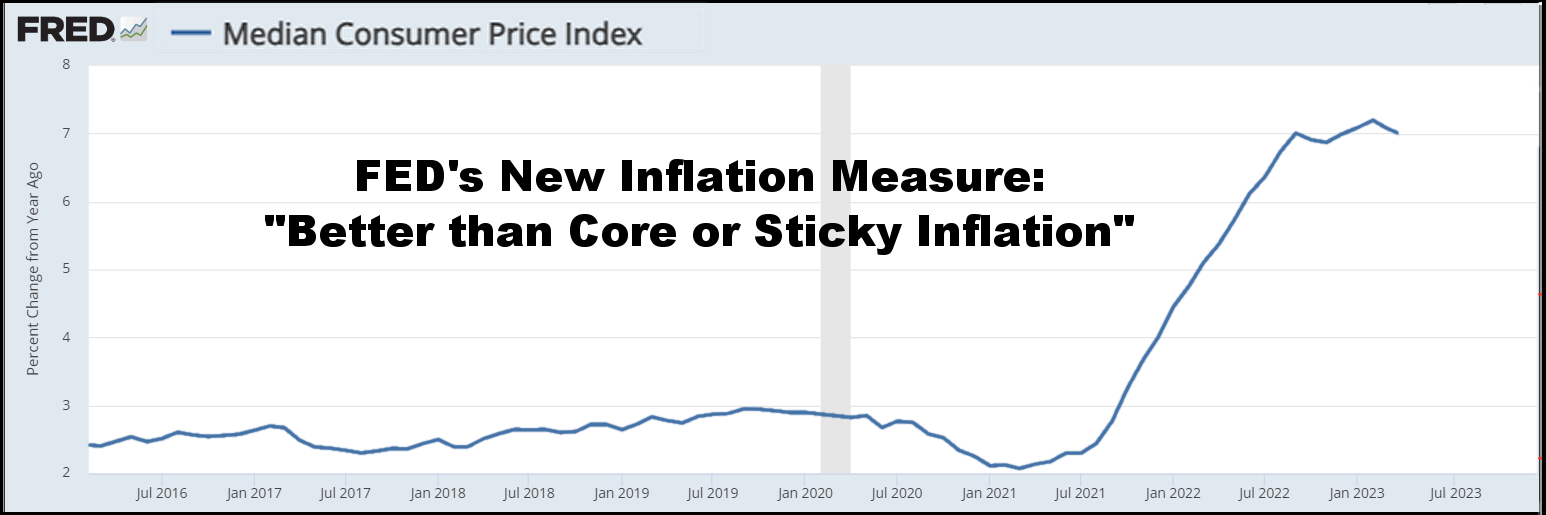

Median Consumer Price Index

According to research from the Cleveland Fed, the Median CPI provides a better signal of the inflation trend than either the all-items CPI or the CPI excluding food and energy. Although it appears that inflation growth may be contained, there is no clear sign of a start to a decline. Thus, when there are continuing signs of a hot economy, it can be a sign that higher interest rates may be necessary.

Inflation: Contained but not Declining (Yet)

M2 Money Supply – The Lubricant

The availability of spending money is the lubricant for commercial transactions. The M2 (chart right) is now rolling over because the Fed went from a Quantitative Loosening Policy of injecting nearly $100B per month of liquidity into the economy to a Quantitative Tightening Policy of removing nearly $100B per month of liquidity from the economy. If the sloped horizontal line represents a well-balanced economic period, then perhaps bringing M2 back to that line would be approximately when the long-awaited recession might take root. Of course, the problem is that an economic contraction also has momentum and makes economic pain likely.

Inflation: Contained but not Declining (Yet)

Scott Interviewed on Nasdaq Trade Talks

In this video, Jill Malandrino of Trade Talks interviews Scott Juds about Merlyn.AI’s use of artificial intelligence in our Indexes and how it differs from the ChatGPT form of AI that we have been hearing about in the media. She also asks about how we use advanced signal processing to complement AI to further improve performance. Finally, Jill enquires about the recent nature of the market and how the algorithms have adapted to address it.

Patience, not panic! Rules, not emotion!

May the markets be with us,

Disclaimers:

Investing involves risk. Principal loss is possible. A momentum strategy is not a guarantee of future performance. Nothing contained within this newsletter should be construed as an offer to sell or the solicitation of an offer to buy any security. Technical analysis and commentary are for general information only and do not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of any individual. Before investing, carefully consider a fund’s investment objectives, risks, charges and expenses, and possibly seeking professional advice. Obtain a prospectus containing this and other important fund information and read it carefully. SumGrowth Strategies is a Signal Provider for its SectorSurfer and AlphaDroid subscription services and is an Index Provider for funds sponsored by Merlyn.AI Corporation. SumGrowth Strategies provides no personalized financial investment advice specific to anyone’s life situation, and is not a registered investment advisor.